When I saw the interest rate offered on CIT Bank’s Savings Builder accounts, I knew I had to open an account.

Now that I’ve opened an account, I wanted to share my Savings Builder account review with you so you can earn crazy interest rates on your savings, too.

Currently, CIT Bank offers one of the highest interest rates available on a savings account with their Savings Builder account, as long as you meet their minimum requirements.

While most banks require you to have insane amounts of money to earn the highest interest rate, Savings Builder doesn’t work that way.

You can qualify for the highest Savings Builder interest rate by keeping $25,000 or more in the account, but you can also keep the Upper Tier interest rate by saving consistently.

All you have to do is make a $100 deposit into your Savings Builder account each month by their monthly deadline to keep the Upper Tier interest rate. More on that later.

Before we dig more into the account, let’s address the elephant in the room. You probably haven’t heard of CIT Bank. That’s okay. I’ll explain.

Who Is CIT Bank?

CIT Bank is a major US bank that’s part of CIT Group Inc., which has been around for over 100 years.

CIT Bank is a major US bank that’s part of CIT Group Inc., which has been around for over 100 years.

On the personal banking side of things, CIT Bank offers money market and Savings Builder accounts as well as certificates of deposit and fixed-rate mortgages.

CIT’s bank accounts are FDIC insured, which means your deposits will be insured up to $250,000 per depositor for each account ownership category.

In addition to personal banking, CIT also offers business and commercial banking services like equipment financing and working capital loans.

So why haven’t you heard about CIT Bank before? Unless you deal with business financing on a regular basis or have been looking for a high yield savings account, you probably wouldn’t have come across them.

CIT Bank is an online bank which means they don’t have any CIT Bank physical locations. Even though CIT is a major bank, they don’t offer typical personal banking services, like checking accounts, online.

For that reason, CIT Bank is best for savers that are looking to earn a high interest rate on their savings.

What Is Savings Builder?

Savings Builder is CIT Bank’s high interest rate savings account product. The account offers two tiers of interest rates.

Savings Builder really shines with their Upper Tier interest rate. It’s one of the highest interest rates available on a savings account. The Base Tier interest rate is still higher than the vast majority of brick and mortar banks.

Open a CIT Bank Savings Builder High Yield Savings Account

How Savings Builder Works

All savers will get the Upper Tier interest rate from the date their account is open until the first Evaluation Day. More on Evaluation Day in a second. After that, you’ll have to qualify to earn the Upper Tier interest rate.

You can get the Upper Tier interest rate in one of two ways. First, you can maintain a balance of $25,000 or more in your account. This won’t be easy for most people, so CIT Bank offers another way to earn the Upper Tier interest rate.

If you don’t have $25,000 to keep in the account, you can earn the Upper Tier interest rate as long as you make a $100 or larger deposit at least once per Evaluation Period.

It’s important to note, your deposit has to be a single deposit of $100 or more to count. You can’t make two $50 deposits to earn the Upper Tier interest rate.

What Is Evaluation Day?

Evaluation Day is a really confusing concept. I couldn’t get my head around it until I read an example, so I’ll share both the technicalities of how it works and an example.

The Technicalities of Evaluation Day

Evaluation Day is the day CIT Bank checks to see if you met the requirements to earn the Upper Tier interest rate tier for the following Evaluation Period.

Evaluation Day is the fourth business day prior to the end of a month. An Evaluation Period begins the day after an Evaluation Day and ends at 4:00 PM PT on the next month’s Evaluation Day.

On Evaluation Day, CIT will check to see if your account has an end-of-day balance of at least $25,000 or there has been at least one deposit of $100 or more that posts to the account during the Evaluation Period.

If you meet either of these conditions, you’ll earn the Upper Tier interest rate. If you don’t, you’ll earn the Base Tier rate. Then, next month the process will happen again and determine the interest rate tier you’ll earn for the following month.

Your First Evaluation Day and Evaluation Period

Your first Evaluation Day will take place at the end of the first Evaluation Period after you open your account.

Your first Evaluation Period will begin on the first business day of the month after you open your account and ends at 4:00 PM PT on the next month’s Evaluation Day unless your account was opened on the last two business days of a month.

For accounts opened on the last two business days of a month, the first Evaluation Period will begin on the first business day of the second month after account opening and end at 4:00 PM PT on the next month’s Evaluation Day.

An Evaluation Day Example

If you’re confused, I don’t blame you. Here’s an example to make it a bit easier to understand.

Let’s say you open your account on January 12, 2019 with $1,000. Your first Evaluation Period would run from February 1, 2019 through February 25, 2019. Your first Evaluation Day would be February 25, 2019.

To keep the Upper Tier interest rate, you’ll need to either have an end-of-day balance of $25,000 on February 25th, 2019 or have made a $100 deposit during the first Evaluation Period of February 1, 2019 to February 25, 2019.

Note: Your first Evaluation Period does not begin when you open your account. If you make a $100 deposit before the beginning of your first Evaluation Period, it will not count toward the minimum $100 deposit requirement for your First Evaluation Period.

Savings Builder Fees

CIT Bank’s fee schedule is pretty awesome for most banking customers.

They do not charge fees for:

- Opening an account

- Monthly maintenance fees

- Mailing a check

- Accepting an incoming wire transfer

- Making an online transfer

- Closing your account

They don’t charge a fee for outgoing wire transfers if your account has an average daily balance of $25,000 or more, but they do charge a fee of $10 per outgoing wire transfer if your average daily balance is less than $25,000.

You will have to pay a return deposit item fee of $10 per item.

If you decide to open a Money Market account, which is not Savings Builder, they do charge:

- Money Market account excessive transaction(s) fee: $10 per transaction starting from the first violation with a monthly $50 cap

- Money Market account Bill Pay stop payment fee of $30 per check

Savings Builder Account Minimums

To open a Savings Builder account, you must have a minimum opening deposit of at least $100. This $100 or more initial deposit does not count toward the qualifying deposits to earn the Upper Tier interest rate for future Evaluation Periods.

The opening minimum balance is a good test to see if you’ll use the product to its maximum potential going forward.

If you have trouble scraping together $100 to make the initial deposit, you may have a hard time qualifying for the Upper Tier rate on a regular basis.

Why I Opened CIT Savings Builder Account And You Should Too

When I saw CIT Bank’s Savings Builder interest rate, I quickly realized it was higher than I was earning in my other online savings account. Then, I saw CIT Bank raise the rates offered and I knew I had to try the product out.

Normally, I don’t rate chase for the highest interest rate bank account. Small differences in interest rates of 0.10% or 0.20% don’t make a huge deal unless you have a massive savings account, which I sadly do not.

Once I realized that CIT Bank was serious about keeping their Savings Builder account a top contender when it comes to interest rates, I knew opening a Savings Builder account would be a smart move for my family.

Open a CIT Bank Savings Builder High Yield Savings Account

Pros Of Savings Builder

- Savings Builder offers an amazing Upper Tier interest rate

- Savings Builder accounts encourage you to maintain or grow your savings with at least $100 monthly deposits

- No crazy fees to watch out for

- You can withdraw money from your account without disqualifying yourself for the Upper Tier rate even though you may have to make a $100 deposit to earn the Upper Tier rate

- Automatic transfers allow you to easily make sure you always qualify for the Upper Tier Rate

- Interest compounds daily and is deposited monthly

Cons Of CIT Bank’s Savings Builder Account

- The concept of Evaluation Day and Evaluation Periods can be confusing until you wrap your head around it

- Outgoing wire transfers cost $10 if you have less than an average daily balance of $25,000

- Even so, you get free online ACH transfers which you can use, they just take a bit longer than a wire transfer does

- Because Savings Builder is a savings account, federal law limits your monthly transfers out of your account to six or fewer thanks to Federal Reserve Board’s Regulation D

- If you reach your six withdrawal limit, you can still withdraw money by requesting them to mail you a check

- CIT Bank is an online-only bank that doesn’t offer in-branch customer service

- Savings Builder’s Base Tier can easily be beaten by other online banks if you forget to qualify for the Upper Tier

Ways To Use A Savings Builder Account

CIT Bank’s Savings Builder account has a ton of potential uses that really excite me for both myself and my readers.

First, Savings Builder is the perfect account to use if you’re just getting started building your emergency fund. The $100 deposit required to earn the Upper Tier rate should motivate you to keep growing any size emergency fund.

It helps your emergency fund grow by getting you a higher interest rate and by adding to the account on a regular basis.

Savings Builder accounts can also be used to help you save for big future goals you know are coming. You could use a Savings Builder account to put away money for:

- College education for your kids

- Your family vacations

- Your first home

- Your dream home

- A sinking fund for large future expenses like a new car, hot water heater or roof for your home

CIT Bank Customer Service

CIT Bank’s customer service can be reached in two main ways. If you’re not in a rush, you can send CIT Bank a message through your online banking. They typically respond in one to two business days.

However, if your question is urgent or you just like picking up a phone and talking to a human, you can call 1-855-462-2652 which is available:

- Monday through Friday: 9:00 AM to 9:00 PM (ET)

- Saturday: 10:00 AM to 6:00 PM (ET)

- Sunday: Closed

Opening a CIT Bank Savings Builder Account

I recently opened a Savings Builder account and took screenshots of the process to show you how it works.

Open a CIT Bank Savings Builder High Yield Savings Account

Keep in mind, the below screenshots are accurate as of when I opened my Savings Builder account in December 2018. Additionally, the screenshots below only follow the process for the specific options I’ve chosen. Your process may be different. I have redacted my personal information in certain screenshots. If an area is blank where text should be is blank, that’s why.

Step 1: Pick from the options to open an account

In my case, I selected “I am a new customer”.

Step 2: Verify you’re a new customer

Step 3: Confirm the type of account you want to open

Step 4: Select an individual or joint account

Step 5: Enter information about the primary applicant

Step 6: Enter additional information about the primary applicant

Step 7: Enter employer information for the primary applicant

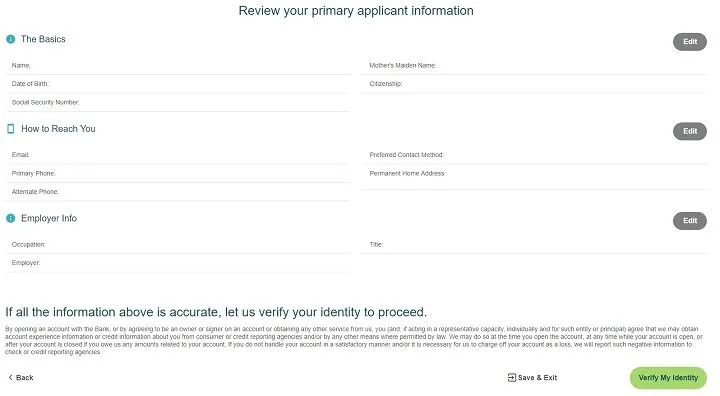

Step 8: Review and confirm information about the primary applicant and verify your identity

Step 9: Enter co-applicant information if applicable

Step 10: Enter additional co-applicant information if applicable

Step 11: Enter employer info for the co-applicant information if applicable

Step 12: Review and confirm information about the co-applicant and verify their identity

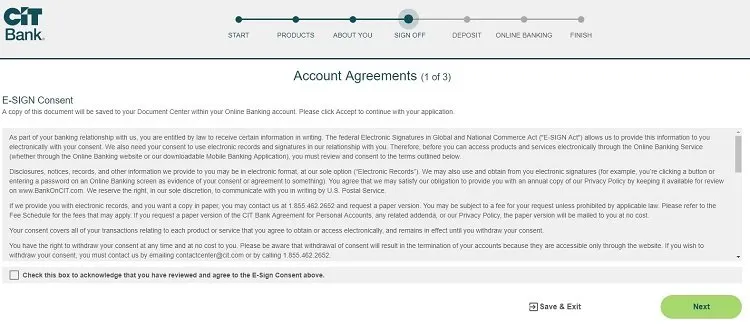

Step 13: Agree to account agreements

Step 14: Review backup withholding status and taxpayer identification number certification

Step 15: Read, save and agree to account agreements

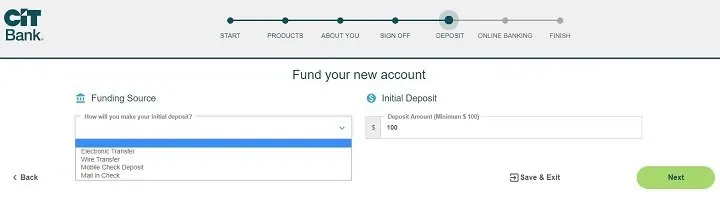

Step 16: Fund your new account in one of four ways

Step 17: If funding by electronic transfer, choose one of two ways to verify your funding account

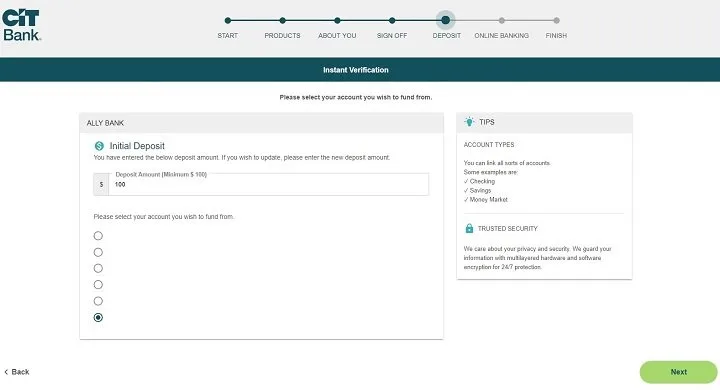

Step 18: If choosing instant verification method, agree to the terms

Step 19: Select or search for your financial institution for instant verification

Step 20: Enter login credentials for your funding account to instantly verify your account

Step 21: Select the amount of your initial deposit and the specific account from your funding institution you wish to make the deposit from

Step 22: Confirmation of verified and linked your account as a funding source

Step 23: Add a beneficiary if you choose

Step 24: Designate type of beneficiary

Step 25: Provide information about your beneficiary

Step 26: Confirm or add additional beneficiaries

Step 27: Create your online banking username and password

Step 28: Final confirmation screen

Setting Up Automatic Transfers To Qualify For The Upper Tier Interest Rate

Once you open your Savings Builder account and log in for the first time, I highly suggest you set up an automatic monthly transfer of at least $100 per month.

I decided to set mine up on the 11th of each month so it fell in the middle of an Evaluation Period.

Here’s how I set up an automatic monthly transfer after I opened my account.

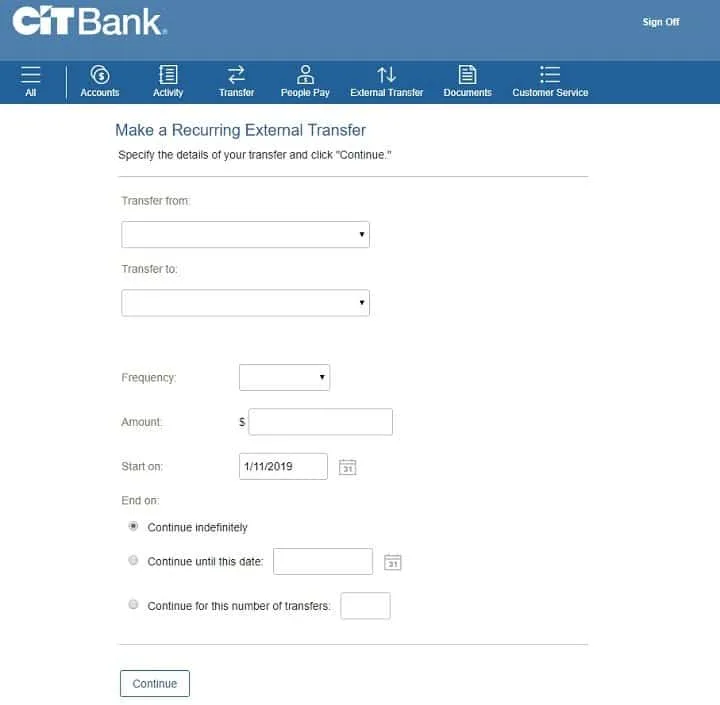

Step 1: Click external transfer from the navigational menu

Step 2: Click set up recurring transfers link under “Transfer on:” date

Step 3: Select relevant information to set up your recurring transfer. Select the frequency of monthly for monthly transfers and continue indefinitely if you want the transfers to happen every month until you stop them

Step 4: Verify information and click submit transfer

The Final Word

CIT Bank Savings Builder accounts are an amazing option for people looking to build a habit of saving on a regular basis and those that have $25,000 or more to leave on deposit at CIT Bank.

The Upper Tier interest rate CIT Bank offers on their Savings Builder accounts is usually one of the best available, allowing the money in your account to grow faster.

The offer was so tempting I opened an account myself. I’m glad I did and hope to continue enjoying CIT Bank’s Savings Builder account for years to come.

Open a CIT Bank Savings Builder High Yield Savings Account

If my opinion about the account ever changes, I’ll be sure to update this post as soon as possible so you’re always getting my most up to date thoughts on this product.

This review is editorial content and is solely my honest opinion of the product and service. It is accurate to the best of my knowledge as of January 11, 2019, but you should read the terms and conditions on CIT Bank’s website as those details, not the ones listed on this website, are the ones that govern your relationship and your accounts with CIT Bank.

CIT Bank Savings Builder Account

Pros

- Usually offers a competitive APY

- Easy to open an account

Cons

- Bank isn't well known

- Must meet requirements to earn higher rate

Lance Cothern, CPA holds a CPA license in Indiana. He’s a personal finance, debt and credit expert that writes professionally for top-tier publications including U.S. News & World Report, Forbes, Investopedia, Credit Karma, Business Insider and more.

Additionally, his expertise has been featured on Yahoo, MSN, USA Today, Reader’s Digest, The Huffington Post, Fast Company, Kiplinger, Reuters, CNBC and more.

Lance is the founder of Money Manifesto. He started writing about money and helping people solve their financial problems in 2012. You can read more about him and find links to his other work and media mentions here.

Beau W.

Thursday 14th of May 2020

What I love about this bank is you can set up multiple accounts for saving money for any future things you want to buy. Sinking funds. Ive set up 4 different accounts for saving money every paycheck for future purchases.

DP

Friday 5th of April 2019

I'm glad I'm not the only person, who struggled with the Eval Period. Your explanation of the Evaluation Period, encouraged me to join your mailing list. Thank you...

Lance Cothern

Friday 5th of April 2019

I'm glad I could help! Let me know if you ever have any other questions I can help out with!

Carolyn

Sunday 13th of January 2019

Awesome. Interestingly I was just looking at this Fri

Lance Cothern

Sunday 13th of January 2019

Let me know if you have any questions :)