Liquid net worth is how much money you’d have leftover if you immediately sold off all of your assets that are easy to convert to cash and paid off your related debts at the same time.

It does not include assets that are difficult to sell such as cars, homes and business equity.

If you take your finances seriously, chances are you’re already tracking your net worth. But are you tracking your liquid net worth or your traditional net worth?

Knowing your traditional net worth shows how you’re progressing financially in a big picture sense.

Unfortunately, traditional net worth can be a bit misleading.

This is especially true if you’re working toward financial independence or you need help making a major life decision.

In these cases, using your traditional net worth is flawed. Instead, you should be using your liquid net worth.

Here’s what you need to know about the differences.

Calculating Your Traditional Net Worth

Traditional net worth is relatively easy to understand. It’s a simple formula I learned in my accounting classes in college.

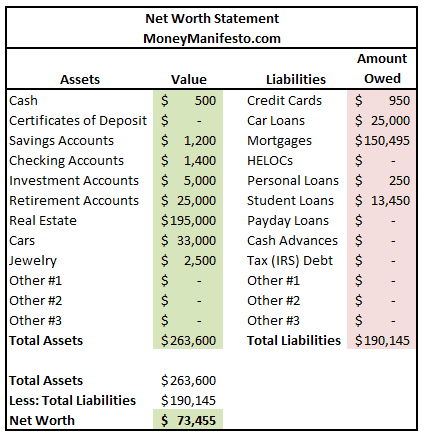

Net Worth = Assets – Liabilities

Assets are anything with value. While assets could technically be absolutely anything, including your clothing, most people limit their net worth calculations to their major assets.

Personally, the smallest asset I include in my net worth is my car.

Anything worth less than my car that isn’t cash, in a bank account or an investment account isn’t counted. That means I don’t count my furniture or my household items in my net worth.

Liabilities are debts you owe to others. This can include mortgages, credit card debt, car loans and money you owe to family and friends. I always include all of my debts in my net worth calculations because I have to pay them no matter what.

The amount left over after you subtract your liabilities from your assets is your net worth.

If it’s positive, you’d have money left over if you sold absolutely everything you own and pay off your debts. If your net worth is negative, you’d still owe money after selling everything.

What Is Liquid Net Worth And How Is It Different?

Liquid net worth is slightly different than traditional net worth.

The key difference is liquidity, or the ability to sell your assets quickly. The liabilities side of net worth may or may not change in this calculation based on your judgment.

It’s important to note that this is not a defined calculation. It involves making judgment calls on what you consider liquid and what you don’t.

Ultimately, you should calculate this type of net worth in a way that makes the most sense for your particular situation. That said, here are some considerations to think about and guidelines you can follow.

What Are Liquid Assets?

Technically, liquid assets are assets you can quickly convert to cash.

Obvious liquid assets include cash and money in your bank accounts. Things get trickier once you get beyond these two assets.

In some cases, it’s easy to convert your assets to cash, but it may not always be a smart move.

For instance, you can usually sell investments in a taxable investment account within a day.

However, if the prices of your investments aren’t ideal at the time, you could lose a significant amount of money. If you sold during the 2008 stock market crash, you would have gotten a much lower amount than if you sold in 2005.

Investments can also be complicated by the types of accounts they’re in. Many retirement accounts require you to pay penalties and taxes if you withdraw the money before you reach 59 and 1/2.

While you could sell these assets and withdraw the cash immediately, you wouldn’t get the face value. Instead, you only get the amount after taxes and penalties are figured.

Technically, these are liquid assets because you could sell them quickly. It just isn’t always a smart move.

Assets That May Or May Not Be Liquid

A few major line items on some traditional net worth statements aren’t always liquid assets. These usually include cars, homes and equity in any businesses you own.

Cars

In some cases, you could consider cars a liquid asset. If you have a car dealership in town that’s willing to buy your car without having you buy a car at their dealership, they could be liquid assets.

That said, you’ll likely lose quite a bit of money and the dealership may not be interested in your particular vehicle for whatever reason.

If you have to sell your car the private party route, it usually takes a few weeks. This would mean your car isn’t a liquid asset.

Ultimately, it’s up to you whether you consider your car a liquid asset or not.

Homes

Selling your home in a day is near impossible. You may be able to find an investor that’s willing to pay cash on short notice, but even then I don’t think you could close the transaction in a day.

For this reason, I almost always exclude my home from my liquid net worth.

Businesses You Own

Selling a business is often more complicated than selling a home. It takes longer and buyers want time to perform due diligence to make sure everything is as it seems.

I do not include any business equity in liquid net worth calculations and suggest you do the same.

Discounting Assets To Reflect Their Liquid Values

To get the real picture of how much money you’d have with your liquid net worth, you’ll need to discount some of your assets to reflect their true liquid values. Here are a few guidelines.

- Cash – 100% of value

- Certificates of Deposit – 100% of value minus early withdrawal penalty

- Taxable investment account investments – 100% of daily value minus taxes owed (if you want to factor in a downturn in asset prices, you can use a lower amount such as 80%)

- Retirement accounts – 100% of daily value minus applicable taxes and 10% early withdrawal penalty (you can also factor in a downturn)

- Cars – Use a conservative KBB.com trade-in value

- Houses – If you must include your house, include a discount for closing cost, real estate agent fees and a quick sale price. Personally, I’d use 75% of my house’s conservative value.

- Business Equity – Do not include

Should You Include All Liabilities?

This part of calculating your liquid net worth is tricky. If you aren’t including your car, home or business equity in your liquid assets, should you include your car loans, mortgage debt and business debt in the calculations?

This is up to you. Personally, I would only include any amount of debt that I owed in excess of the asset’s value. For instance, if I owed $1,000 more on my car than it is worth, I’d include that $1,000 in my calculation.

Things To Consider When Calculating Liquid Net Worth

One goal of calculating your liquid net worth is to see how much you’d have in an absolute worst case scenario.

My family learned how important having liquid assets (in the form of an emergency fund) was when a category 5 hurricane hit our hometown. Without liquid assets, your financial life can quickly unravel.

If this is why you’re running the numbers, here are a few things you’ll want to incorporate into your calculations:

- Make sure you list the asset value at what you could get for it today after any selling fees.

- Only include assets that you could cash out today.

- Consider not including assets you wouldn’t be willing to cash out today if the market conditions aren’t favorable or list them at a discounted value in your calculations.

- Make sure you carefully consider which liabilities to include.

- If you don’t want an immediate value, consider calculating the same information based on what you could get for your assets if you sell them within 30 days instead of one day.

Liquid Net Worth For Financial Independence

Another reason you may want to calculate your liquid net worth is if you’re trying to achieve financial independence. In this case, you usually want to know if you can provide enough income from your assets to live without working.

When calculating your liquid net worth for the purposes of financial independence, keep these things in mind:

- Don’t include assets that you won’t be using to generate income in retirement. Leave cars, homes and business equity out.

- Only include investments you can access without penalties. If you have to pay penalties or taxes on the assets, discount their value to what you’d receive after these amounts.

- Don’t include liabilities for your car, mortgage or business debt if you already include these factors in your monthly expenses.

- Consider discounting investments in case their value dips early in your post financial independence life so you can see if you can withstand a downturn.

- You can divide your liquid net worth by your total yearly expenses to get the number of years you could live on your assets without running out of money.

Free Liquid Net Worth Calculator Tools

If you want to quickly calculate your liquid net worth, there are a couple of tools I would recommend.

First, you can download our free liquid net worth calculator by signing up for our newsletter. The net worth calculator can be used for both types of net worth.

When using this tool, only include the assets and liabilities you’d like to calculate your numbers based on. Because the calculator is a spreadsheet, you can easily adjust values by multiplying them by a decimal.

For instance, you can make your car worth 80% of its current value by multiply by 0.80.

The other tool you may want to consider using to calculate your net worth can greatly speed up the data collection process.

I use Personal Capital to track all of my investment and cash accounts in one place.

You can sign up for Personal Capital here and add your accounts to track your true net worth.

Then, you can take that information and input it into the free spreadsheet without having to log in to multiple accounts each time you want to calculate your liquid net worth.

Related: Is Personal Capital Safe To Use?

Do you have any questions about how to calculate your liquid net worth? Leave them in the comments below and I’ll be sure to answer them.

Lance Cothern, CPA holds a CPA license in Indiana. He’s a personal finance, debt and credit expert that writes professionally for top-tier publications including U.S. News & World Report, Forbes, Investopedia, Credit Karma, Business Insider and more.

Additionally, his expertise has been featured on Yahoo, MSN, USA Today, Reader’s Digest, The Huffington Post, Fast Company, Kiplinger, Reuters, CNBC and more.

Lance is the founder of Money Manifesto. He started writing about money and helping people solve their financial problems in 2012. You can read more about him and find links to his other work and media mentions here.