What is my net worth?

What is my net worth?

It’s a common question a lot of people don’t know how to answer.

Net worth sounds like a fancy calculation that would be difficult for the average person to calculate.

Luckily, that’s not the case.

Calculating your net worth is extremely straight forward as long as you understand the components of your net worth.

My wife and I have been calculating our net worth every month for a few years now. The insight it gives us into our personal finances is amazing. It’s also neat to look back to see how far we’ve come.

Today, we’ll dive into the components and how to calculate them which will allow you to figure out your net worth for the first time.

Net Worth = Assets – Liabilities

I have a very thorough understanding of these definitions as an accountant, but I realize not everyone else has the same background as me. Fortunately, these aren’t hard to learn.

Let’s get started by learning the definitions of assets, liabilities and net worth.

What Are Assets?

Assets are things you own that have value. Another way to look at assets is to think of them as things that you can sell to make money if you need to.

Some examples of assets include:

- Cash

- Certificates of deposit

- Savings and checking accounts

- Investments (stocks, bonds, mutual funds, ETFs, REITs, etc)

- Retirement accounts

- Real estate

- Cars

- Jewelry

- Any other item of value

The list above definitely doesn’t list every possible asset. Furniture, computers, cell phones, appliances and TVs can also be considered assets.

The problem with these assets is their values often begin to diminish rapidly so my wife and I don’t include them in our calculations.

You can include them in your calculations if you wish. Just make sure to only include the value you could get if you sold it today, not the price you paid.

What Are Liabilities?

Liabilities are what you owe other people and institutions, like banks. If you borrowed money to buy a house or a car, then your mortgage or car loan would be considered liabilities.

Some examples of liabilities include:

- Credit card debt

- Car loans

- Mortgages

- Home equity lines of credit or loans

- Personal loans

- Student loans

- Payday loans

- Cash advances

- Tax debt

- Any other form of debt not listed

Anything you owe to anyone should likely be considered a liability. This list doesn’t include every liability possible, but it does cover the major ones most people will have. If you owe money to someone or an institution, then chances are you have a liability.

Make sure you list all of your liabilities to get an accurate calculation. Unlike with assets, you want to include everything because you’ll have to pay off all of your liabilities, or debt, at some point in the future.

Your Net Worth Statement – How To Calculate It And What It Is

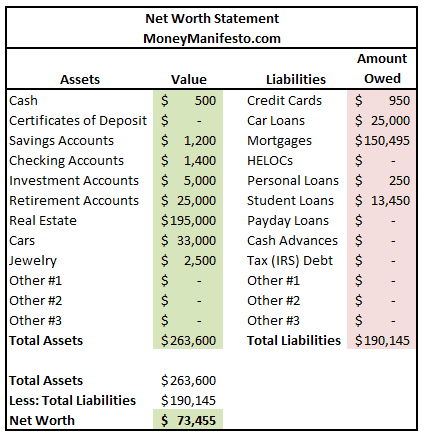

Now that we know what assets and liabilities are, we can calculate your net worth and produce a net worth statement.

To start the process, open up a spreadsheet or grab a piece of paper and a pen. Once we’re done, this will be your net worth statement.

Next, make two sections, one for your assets and one for your liabilities. Using the lists above as an example of what to include, write down all of your assets and their current value. Then, write down all of your liabilities and the amount you owe for each one.

Once you’re done listing your assets and liabilities, add up each category to get a total number for the value of all of your assets and a total number for how much you owe for all of your liabilities.

Simply take your total assets and subtract from that the amount of your total liabilities and you’ll have your net worth. As an equation and simple definition, net worth is calculated as follows:

Assets – Liabilities = Net Worth

Once you complete the exercise, your spreadsheet or piece of paper might look like the net worth statement below. If you’d like a copy of the excel spreadsheet in the image below, please contact me and I’ll email it to you.

Why A Net Worth Calculation Is Useful

Your net worth will tell you how much money you’d have left over if you sold all of your assets, paid off all of your liabilities today and started out all over again with nothing but cash.

Realistically, I know that you’ll never sell all of your assets and pay off all of your liabilities in the same day. If your net worth is negative it wouldn’t even be possible. So why do I think net worth is important?

Net worth is a benchmark that you can use to measure your progress. The more assets you accumulate the better off you’ll be financially, in general.

I say in general because if you’re a hoarder chances are what you consider “assets”, most people probably consider junk… just sayin’.

If you’re just getting started in your financial journey, don’t be surprised if you have a negative net worth.

You should always strive to have a positive and growing net worth, unless you’re retired, so find ways you can make more money or spend less in order to increase your assets and pay off your liabilities.

That said, a negative net worth is nothing to be ashamed of. Everyone has to get started on their financial journey somewhere.

[Related: 123 Ways To Save Money]

How To Automatically Track Your Net Worth Every Day

Thanks to technology, you can track your net worth every day if you wish. Personally, I wouldn’t recommend checking in on your net worth more than once a month, but here’s how to get an almost automatic net worth number.

First, you’ll need to sign up with Personal Capital. Personal Capital is an investing service that offers some amazing and free financial tools regardless of whether you decide to hire them to manage your investments.

The free financial tools are what you’ll use to automatically track your net worth every day.

- First, sign up for a Personal Capital account.

- Next, link all of your asset accounts including bank and investment accounts. You can also manually add assets for assets that don’t have an associated online account.

- Finally, add all of your liability accounts. For any liabilities that don’t have an online account, make sure to add them manually.

Now Personal Capital will automatically update your net worth every day. You only have to update the values of any manual assets or liabilities you added.

But is Personal Capital safe to use? You don’t have to worry about linking your accounts with Personal Capital because they use bank-level encryption to protect your information.

Some Things to Keep in Mind

- Make sure to revisit the value of your assets every once in a while. Your car is going to go down in value with every month and mile that passes. To get an accurate value for my car I use Kelly Blue Book‘s private party value.

- If you own a house it is often difficult to value it. Use your best guess but try not to over estimate. I use Zillow and Trulia to try come up with estimate but understand that it may not work well in your area.

- Another alternative is to talk to a real estate agent friend or check out how much recent comparable homes in your area have been selling for.

- Net worth can fluctuate rapidly if you hold a lot of investments and the market is making big moves every day. Try not to get too upset if your net worth goes down a lot one month or too excited if it skyrockets.

- Over time and with some effort your net worth should grow if you are spending less than you earn, are you paying down debt and/or are investing.

- I track my net worth monthly. Personally, I wouldn’t suggest you track it any more often than that. I use a Personal Capital to track my net worth and update my manual assets and liabilities once a month.

- Other types of net worth exist, as well. For instance, liquid net worth focuses on how much money you could get for your assets today.

Do you calculate your net worth? If not, why not? If so, how often? How do you track it?

Lance Cothern, CPA holds a CPA license in Indiana. He’s a personal finance, debt and credit expert that writes professionally for top-tier publications including U.S. News & World Report, Forbes, Investopedia, Credit Karma, Business Insider and more.

Additionally, his expertise has been featured on Yahoo, MSN, USA Today, Reader’s Digest, The Huffington Post, Fast Company, Kiplinger, Reuters, CNBC and more.

Lance is the founder of Money Manifesto. He started writing about money and helping people solve their financial problems in 2012. You can read more about him and find links to his other work and media mentions here.

cool head

Saturday 16th of August 2014

Very helpful article! Thank you!

One quick question: can Social Security be counted as part of asset?

Lance Cothern

Saturday 16th of August 2014

I'd say it would be a stretch to consider it an asset. Social security is income and you can't get it paid out in a lump sum, so I'd advise against it.

No Nonsense Landlord

Thursday 31st of July 2014

Would you calculate a government pension of 50K a year into a net worth? Or Social Security?

If there are two people, same age, one with 100K in the bank and the other with $0 in the bank, but has a $50K annual pension, who is worth more?

Lance Cothern

Thursday 31st of July 2014

So, if we wanted to be really specific and there was a lump sump payout option for the pension, I'd use that in my net worth. However, if you can't access the money in the pension no matter what, the only way you can value it is the present value of all future payments. Some pensions are rocky these days, which means you'd have to discount it further to put in that risk. At the end of the day, unless you can sell the pension, I probably wouldn't include it in your net worth.

Money Beagle

Thursday 31st of July 2014

I look at net worth as the money I would have if I sold off all of my major assets and paid everything off. It kind of puts a visible aspect to it that way. It also helps define what I consider in my net worth statement (yes, I add in the value of my cars) and what I don't (anything around the house basically).

Lance Cothern

Thursday 31st of July 2014

I definitely think that thinking about it that way helps determine what should and shouldn't be in your net worth.

Tre

Thursday 31st of July 2014

I track my net worth quarterly in a spreadsheet. It's a good indicator of how we are progressing towards our financial goals.

Lance Cothern

Thursday 31st of July 2014

It definitely is a good indicator for your financial goals. That's a great way to look at it.

Amy Turner

Saturday 23rd of June 2012

Nope, I have never done the calculation because I already have the idea how much I'm worth, but this time could be different. Seems like a challenge to find out my net worth.